The phenomenal growth of mobile networking is presenting mobile operators with corresponding challenges as they race to add capacity and services to meet accelerating demands. They are concerned with optimizing their networks cost-effectively as well as generating revenue beyond basic mobile subscriptions. Now, with the intelligence and performance provided by Cisco's end-to-end mobile Internet architecture, platforms, and technologies, mobile operators can promote unique service differentiation to increase revenue opportunities. Real-time subscriber and network intelligence together with policy and charging control in the Cisco® infrastructure can be the basis for mobile operators to enhance services to existing customers, forge new business partnerships with over-the-top providers and other service or application providers, and create new higher-margin services.

Challenge: Capitalizing on Dramatic Mobile Market Growth

Solution: New Capabilities, New Business Models, New Revenues

• Service-aware charging

• Access control

• Policy control

• Content filtering

• Quality of service (QoS)

• Application detection and control

• Filtering, caching, and ad-insertion

• Security

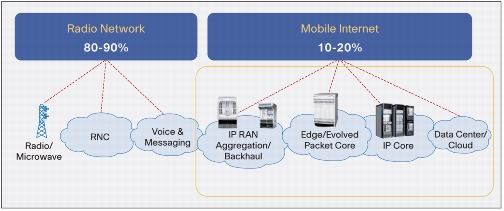

Figure 1. Percentage of Capital Expenditures in Mobile Network Topologies Today

Profits Through Monetization

• Protecting, controlling, and growing the existing services base

• Developing revenue-sharing business models with third-party providers

• Increasing revenues by launching new services

Protecting, Controlling, and Growing the Services Base

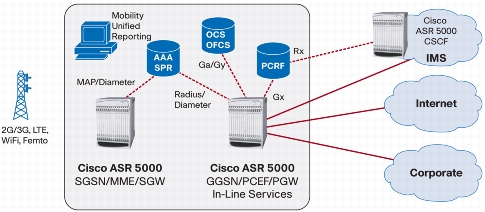

Figure 2. Policy and Charging Control Inline Services - the Baseline to Monetization

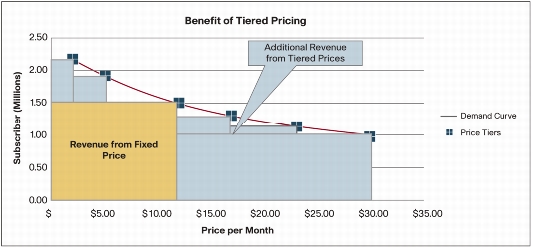

• Tiered services: Policy and charging control can be used to define gold, silver, and bronze service tiers. Each plan can include QoS that is superior to the best-effort service that customers are currently receiving from over-the-top providers. Customers can receive a proactive notification when they are nearing 75 percent of their monthly usage quota. Differentiated billing can be based on usage volume, duration, time of day, or other factors. Even per-event billing and billing based on minutes of usage for push-to-talk services are possible, along with prepaid or postpaid options. Tiered services can increase customer satisfaction levels, helping to ensure that each customer has a plan best suited to their needs. A 2010 study by Network Strategy Partners LLC found that pricing tiers that offer specific content for a flat monthly fee can produce a significant revenue boost as compared to a single pricing plan for flat-rate service, Figure 3.

Figure 3. Tiered Pricing Example

• Roaming: While most roaming solutions are designed to prevent bill shock, frequent roamers can be offered a premium plan or tier that allows access to all services at any time. Other subscribers can be provided with limited access to data services when roaming, but can dynamically opt for higher-bandwidth access as needed for an additional fee.

• Day plans and pre-pay: The proliferation of laptops and netbooks with mobile broadband connectivity has led to a growing number of users who want temporary access when visiting areas not served by their home provider. These mobile users can be given the option to purchase mobile broadband access for a limited duration or for a fixed amount of capacity, similar to the wireless LAN services and pre-pay schemes.

• Parental controls and family quota plan: Adding a charge for network-based parental controls and even a family quota plan for mobile devices can be a popular and lucrative add-on service. Parents can limit access to specific applications, such as phone service and peer-to-peer gaming, or remove privileges or even bandwidth if a child is neglecting schoolwork or otherwise misbehaving. Currently, PC-based parental controls require special software that must be purchased, loaded on each machine, and configured. Mobile parental controls have been virtually nonexistent. Now, however, content filtering and usage controls can tell parents how much bandwidth is being used by which family member on which device and for how long. Parents can block specific applications during the school day or by user or enforce a specific bandwidth ceiling per user per day. These controls can be made available to a parent through a portal, where service limits can be dynamically set and notifications on usage by each family member monitored.

• Turbo service: Requirements for voice and email on a mobile device are much less network-intensive than for multimedia applications such as video and gaming. With turbo service, customers can opt to pay for additional bandwidth on-demand. If a user wants to play a multimedia game or download a movie, for example, a turbo button can enhance the service while the application is in use, providing a higher-quality experience and delivering incremental revenue to the operator.

• Special promotions using enhanced charging: The ability to zero-rate specific application traffic, as desired, gives operators the option of promoting "free" access (also known as "Freemium"). For example, Vodafone Australia designed a promotion for new subscribers tied to a specific device that offered a discounted price plus free access to Facebook. The same concept could be applied to any application traffic, thanks to Cisco's policy solution with deep packet inspection and enhanced charging.

Developing Revenue-sharing Business Models with Third Party Providers

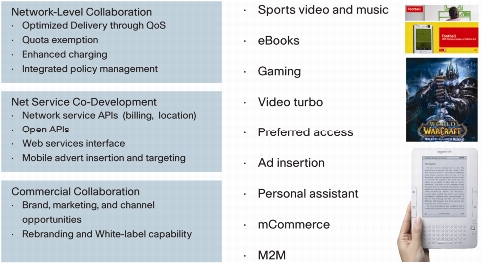

Figure 4. Collaboration with Third-Party Companies for Added Revenue, New Business Models

• eBook service: Given the growth of eBooks, an exciting opportunity exists for mobile operators to partner with device vendors and content owners to get a percentage of revenue from eBook downloads. An example of such a collaborative agreement was reached by AT&T with Amazon.com and Borders Books. Amazon sells the Kindle eBook reader and has a content agreement with Borders Books. The consumer is only charged for content purchased, not for network access. AT&T receives a revenue share of each book delivered, providing one-touch, 30-second guaranteed downloads of books. The AT&T and Amazon collaboration also provides customer and network intelligence that allows for data mining that can be used to promote content specials and cross-selling opportunities based on location, time of day, customer preferences, and other factors.

• Sports, music, and other specialty content subscriptions: The ability to identify and differentiate applications on the mobile network can also be applied to special subscriptions for access to sports and music on mobile devices. Vodafone UK has partnered with Sky Broadcasting, for example, to provide subscribers with an all-the-football-you-can-watch-per-month premium streaming service for £5 per month or 50p per highlight. Vodafone and Sky Broadcasting split the revenue. The service also includes score and game alerts and is much like the addition of a premium channel in a cable TV subscription plan. Another service available through Vodafone UK is an unlimited music option for £1.99 per week that includes full track downloads and occasional free streaming video. Both of these services are billed based on flat rates instead of bandwidth (zero-rated on their subscription) and these and other bundled service packages have proven very popular with football and musical fans alike.

• Gaming subscriptions: Bandwidth-intensive games such as World of Warcraft can provide consumers with assured quality experiences on mobile devices and operators with new revenue from service agreements with game providers. An existing subscription with a gaming company could be extended by the mobile operator to include use on mobile devices. The mobile subscription could be offered as a standalone add-on or as part of a tiered service. Different price points could be offered based on peak and off-peak usage hours.

• Application stores: Many of today's very popular and lucrative mobile application stores provide no monetization for the mobile operator. Instead, revenues flow to the application store owner and the entity that controls the portal. But with the intelligent Cisco mobile Internet infrastructure, mobile operators can partner with application vendors to help them promote their products and services, share associated advertising revenues, and get a percentage of licensing revenues. The application provider gains access to the network resources, gets real estate on the operator's captive portal, and can benefit from bundled pricing and other service offerings. Telenor Norway's Content Provider Access initiative currently generates 6 percent of the operator's revenue.

• Preferred access: The ability to provide QoS and dependable access through 2G, 3G, 4G, or other standards instead of best effort is a powerful competitive differentiator. The intelligence provided by Cisco solutions allows content providers to pay for preferred access or QoS while the user enjoys a superior experience when accessing the specific application. This can be an enhancement to the application store model and to any other application as well, such as video delivery.

• Machine-to-machine (M2M): Application services can be extended to non-traditional mobile devices, such as M2M connections that link wireless data calls between machines. The rapidly growing M2M market (with traffic between machines forecast to triple by 2014 to 75 million calls between machines, according to ABI Research) includes telemetry and telematics applications in health, automotive, surveillance, fleet logistics, transportation, and shipping industries.

Increasing Revenues by Launching New Services

• Rich Communication Suite (RCS) services: This service and feature set for mobile phones is built around presence and a user's phone address book. The RCS client is built into many handsets and once the service is activated, it can show where your friends and associates are and if they are available. Chat sessions, sharing of video in "See what I see" mode, image or file sharing, SMS, and other services are possible with RCS. The service is growing dramatically, especially in Europe, the Middle East, and Africa (EMEA) and Asia Pacific (APAC).

• Social networking services: Mobile operators can utilize their robust, end-to-end networks to promote and monetize high-end social networking environments. One example is Cyworld, a South Korean social networking service. Operated in partnership with South Korea Telecom, the service enables relationships in a virtual world among members who appear as avatars in rooms that they can decorate with objects that they buy. Cyworld encompasses a photo gallery, video, SMS service, and other features. It generated US$200 million in revenue in 2007, the equivalent of US$10 per user (ad-heavy MySpace, by comparison, brings in an estimated US$2.17 per user).

• Social networking with content services: Mobile operators can create their own social network environments or offer the service for branding by partners. Vodafone New Zealand created Vodafone Self Central, a social network platform for mobile phones. It lets consumers create mobile spaces and upload images, video, and audio to these spaces. The content can be downloaded by others within the Vodafone network. Setting up a space is free. Uploading of content is charged based on a standard multimedia message rate (US20 cents to US$1). Others can download content from a subscriber's space for 25 cents per download and the content owner receives a 5-cent credit for each download. The Self Central space can also be used to chat with others and includes unlimited video-streaming services.

Conclusion

For More Information