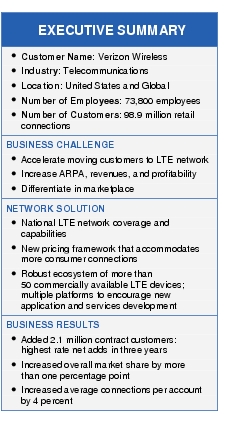

Mobile Data Share Plan

Overview

• National LTE network coverage and capabilities

• New pricing framework that accommodates many more consumer connections, but in a way that reduces the cost of selling, retaining, and managing these added connections and traffic

• Robust ecosystem of more than 50 commercially available LTE devices, with dozens more in the development pipeline

• Multiple platforms that will encourage new application and services development, enable and inspire new services that the company can monetize, and capture customer payments in new, dynamic ways

• Combination of assets and go-to-market advantages that are taking Verizon closer to realizing its vision of the "Internet of Things"

Service Innovation

• Each plan has two components: a line access charge per device, plus a fee for the shared monthly data allowance. Unlimited voice and messaging are bundled into the smartphone access charge.

• Line access charges, which range from US$5 to $20 per month per device, are lower for non-voice devices. Tiered pricing for line access charges enables customers to attach multiple devices to one account, eliminating the need to sign a separate multiyear contract.

• Data charges are $15 per GB for customers who exceed their data allowance. But customers can top up with another 2 GB of data for just $10, provided they do so before their monthly allowance runs out.

• Customers who pay full retail price for a device upgrade are not required to change their existing plan. This provision allows customers currently on the company's discontinued Unlimited data plans to elect not to upgrade, pay full price for their upgrade, and remain on their existing unlimited data plan.

• Much of this growth will be driven by M2M connections from a much wider array of devices and solutions, all aimed at capturing incremental revenues from new services and devices. The Hughes platform, which Verizon acquired from Hughes Telematics in 2012, will enable a number of new opportunities in mobile payments, healthcare, and other areas in both consumer and enterprise segments.

Opportunities

• Accelerate moving customers to its LTE network. This strategy reduces the cost of transporting traffic on its network, helping Verizon to raise profit margins.

• Develop a robust device portfolio to attract new customers, new devices, and help ensure the continued support of key partners. This portfolio positions Verizon to take advantage of new devices and services that they can offer to consumers and businesses to increase the connectivity of customers.

• Move its sales model from selling subscription connectivity, to selling account connectivity. The company has discontinued using ARPU (Average Revenue Per Unit) as a metric and instead moved to ARPA (Average Revenue Per Account). This change not only has the promise of reducing the cost of selling, but it also substantially increases the value of each sale.

Challenges

• Mixed customer reception, as some customers with existing unlimited plans are unhappy about having to make a choice between a subsidized device or continuing their unlimited data plan.

• Substantial monthly line access charge for devices on its data share plans may lower adoption rates and revenue that Verizon might otherwise achieve with lower-cost device access.

• Potential for ARPU dilution that naturally comes with increasing the mix of non-smartphone connections on the network.

• Risk that competitors may introduce more appealing shared data plans.

Strategic Partnerships

• Among its consumer device partners, Verizon has deep and long-standing relationships with top smartphone OEMs including Apple, Samsung, Blackberry, LG, Nokia, and others, allowing the company to provide a compelling variety of devices in its current device portfolio

Success Metrics

• Verizon reported a 50 percent EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) service margin in 3Q12 following the launch of Share Everything; In Q4, similar success with customer uptake was offset in Q4 by the high number of smartphone activations, which raised subsidy costs.

• ARPA grew in 4Q12 by US$9 (6.6 percent) YoY (Year Over Year) to end 2012 at $146. Verizon expected an increase in data consumption based on the enhanced capabilities and speed of the LTE network.

• As of 4Q12, 23 percent of Verizon's postpaid customer base had signed up for a Share Everything plan (approximately 21.3 million customers), up from 13 percent in Q3 2012.

• Added 2.1 million contract customers in Q4 2012, its highest rate of contract customer net adds in three years.

• Increased its overall market share by more than one percentage point, ending 2012 with 33.1 percent share of subscribers.

• Increased its average connections per account by 4 percent, ending 2012 with an average 2.64 devices per account.

• In the past three years, the company has reduced costs in its wireless operating unit by $5 billion; in 2013, the company has set a goal for another $2 billion in cost reductions.

• In 4Q12, Verizon reported that nearly 50 percent of its data traffic resides on its LTE network, which is five times more efficient than on 3G, representing a substantial cost savings.

For More Information