Challenge/Opportunity

• SingTel needs to help ensure that its investment in SME service innovation pays off. Its approach to innovation and funding is a positive move, but it must focus on projects that will develop into real services. Identifying and accelerating promising projects will be the key to commercial success. The SME market is notoriously difficult to address successfully. SingTel needs to focus on services that meet SMEs' business needs, simplicity in pricing, reliability, and ease of use.

• A major challenge for SingTel is to build on its momentum in the SME-dominated domestic market and turn this achievement into pan-Asian success. The market opportunity is clearly substantial: the International Monetary Fund (IMF) predicts that Asia-Pacific will be the largest economic region globally by 2030, and SingTel aims to take a major share of this opportunity. It also has serious ambitions in Africa for mobile services. Altogether it sees a mobile market of 350 million subscribers.

• SingTel will surely face strong competition from other Asian competitors with equally ambitious plans, as well as global service providers with aggressive cloud services plans and established relationships with multinational corporations.

Alliances/Partnerships

• Cisco is a strategic partner in cloud services for SingTel. In September 2010, SingTel announced that it will introduce enterprise cloud-based virtual data center services in Singapore with technology from VCE, the Virtual Computing Environment coalition created by Cisco, EMC and VMware. The services were scheduled to be available in late 2010.

• SingTel was one of the first telcos to announce a partnership with Google, and its OneOffice service for SMEs was successfully built on this collaboration. SingTel aims to attract a large number of partners for its SME cloud offer, including many small specialist players. Those companies known to be MyBusiness partners include CommonTown, Conversant Solutions, F-Secure, NCS, and Paper Terminal.

• SingTel has a strong partnership strategy. Among its other partners involved in its enterprise offers are: Intuit, Samsung, Arkadin, Ericsson, RIM, Juniper Networks, Nokia, Polycom, Riverbed, Sybase, and V3.

• For IT services, SingTel has its own system integration company, NCS, but also partners with a number of ISV players in major verticals.

Strategy

• OneOffice: Office productivity and collaboration suite based on Google Apps

– Tariffs: basic service for five users with extra users charged per month; additional services (fax and Short Message Service [SMS]) pay per use

• ReputationWatch: Developed with social media monitoring company, JamiQ, this service allows tracking of reputation and brand presence on social networks and blogs

– Tariffs: basic service per three topics per month; additional topics per month

• V-Cube Meeting: Web-based video conferencing service

– Tariffs: one-time charge, or monthly charge per user

Success Factors/Metrics/Monetization

• However, with an early entry in the market, SingTel's cloud strategy is starting to pay off on multiple fronts, at least in terms of numbers of customers. It already has a significant number of customers, most of which are local Singaporean enterprises and SMEs. SingTel claims about 100,000 business users of software-as-a-service.

• Given the pricing of OneOffice compared with its standard broadband offer, it is not surprising that SingTel has had success in migrating its SME customers from basic services to higher value bundles and get them using the MyBusiness portal. The real measure of success in Singapore will be in the revenue growth, and profitability returned, from additional services, which will take far longer to achieve.

• In platform-as-a-service, SingTel currently works with 300 ISVs, developing applications, many sold through the MyBusiness portal. One of the company's objectives in setting up its innovation initiative was to develop stronger relationships with the development community, with the assumption that these relationships would lead naturally to new channels to market (that is, from developer partners selling SingTel connectivity as part of their offers). It is too early to measure the success of this strategy, but it looks promising.

• SingTel's infrastructure-as-a-service offerings include:

– Alatum, a virtual data center for on-demand cloud computing infrastructure

– EXPAN Grid, an on-demand computing power and storage offering, for which SingTel claims to currently have 20,000 users.

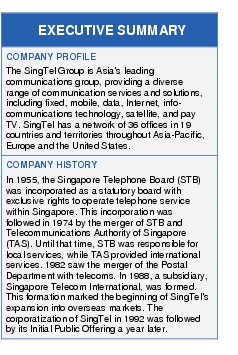

Company Background

• Read SingTel overview

Case Study Source: Cisco sponsored research developed by Ovum