Challenge/Opportunity

• SFR must continue to develop a differentiated offer in a fiercely competitive market, where all players offer standard triple-play services for approximately €30 per month.

• SFR must compete with strong growth of digital terrestrial TV and the increasing range of free channels, which means consumers have a more compelling alternative to pay TV operators.

• SFR needs to develop an effective partnership ecosystem to deliver new content/services quickly and efficiently.

• SFR must help ensure that its new STBs can deliver enhanced functionality to support a more sophisticated multiscreen strategy.

• SFR can build on its leading market position and newly integrated brand (fixed and mobile) to grow consumer revenues, particularly from mobile broadband and content.

• SFR can leverage its multiscreen presence (TV/PC/smartphone) to deliver a combination of free and subscription content to customers.

• SFR can continue to upsell mobile TV users onto higher tariffs as mobile data usage, driven by increased content consumption.

Alliances/Partnerships

• SFR partnered with Deezer (digital music) to develop its own exclusive live music broadcasts from artists that are well-known in France and make them available across multiple platforms.

• SFR partnered with Daily Motion, a user-generated content site that is very popular in France, to deliver standard definition (SD) and high definition (HD) user-generated content to TVs. Customers can access over 10 million SD videos and 30,000 HD videos that are searchable by theme.

• SFR has started to work with WyPlay to develop a more comprehensive multimedia experience in the home with more integration of different functionalities within one device. This is likely to include an emphasis on multidevice connectivity and web services.

Strategy

Success Factors/Metrics/Monetization

• Revenues from fixed broadband were up 9 percent for 2009, and fixed broadband activities are becoming more profitable; year end 2009 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) grew about 45 percent.

• SFR had approximately 500,000 subscribers to its pay TV packages at year end 2009 (a growth of 88 percent year-over-year). OVUM estimates there are more than 400,000 subscribers to the DailyMotion NeufBox channel.

• SFR has also leveraged the growth in mobile data usage (including video) to sell more higher-ARPU mobile data packages. Mobile data revenues grew by 31 percent in 2009.

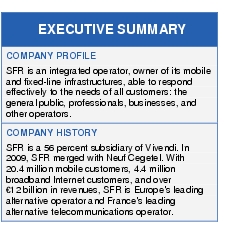

Company Background

• Read SFR overview