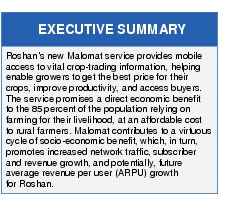

Company Background

Experience Innovation

Opportunities

• Subscriber growth potential in multiple constituencies: Malomat is not just targeted at rural farmers; users of the Malomat service include traders, wholesalers, buyers, distributors, and suppliers, all of whom can use the information provided to transact directly with other participants, or gain real-time insight into trends affecting indirect markets (e.g., farming supplies, irrigation or seed production.) The service has wide appeal and casts a wide net of potential users, increasing traffic on Roshan's network and attracting new subscribers. Obvious prospects for Malomat user growth will come from the:

– 5.8 million existing Roshan mobile subscribers;

– 60 percent of the population (approximately 18 million people) who currently use mobile phone service;

– 85 percent of the population who rely on agriculture- or natural resource-based livelihoods; and nearly 2 million people who currently use M-Paisa for mobile money transfers.

• Positioning at an ideal service intersection: Roshan's M-Paisa money transfer service, which the company also launched in 2011, is well aligned to support the Malomat service. Through these initiatives and the company's role in providing mobile telephony to almost a third of the country's mobile users, Roshan's Malomat service positions the company directly at the intersection of mobile technology, agriculture, and banking, three core elements of Afghanistan's reconstruction and future market growth and recovery.

• M-Paisa is a tool to evolve Malomat from informational to transactional: Although Malomat is not directly integrated with M-Paisa, nor nearly as big, the two services complement and support each other. A significant overlap also exists in the target audience for both services. Furthermore, the availability of M-Paisa helps enable Roshan to take this informational service to the next level by providing a mobile payment solution to a population that is 95 percent unbanked.

The natural synergy between these two services is something that Roshan should exploit moving forward as it works to expand and develop Malomat as a national program. This synergy should lead to additional integration between the two services, allowing users to initiate inquiries on Malomat that turn into M-Paisa transactions later on in the buying and selling process.

Challenges

• Instability, security, and geography hamper profitable mobile coverage: Socio-economic conditions and the fragile security situation pose difficult challenges for infrastructure building in Afghanistan. With the majority of people living in rural areas (only one-quarter of the population lives in urban areas), where farming drives local economies, providing profitable mobile coverage, as well as electricity to charge phones, is also a big concern for Roshan.

• Poverty and illiteracy still challenge the nation: Poverty among the Afghan people is rampant and particularly affects small growers who make up a large proportion of the rural population. High poverty means Roshan is limited in the types and costs of mobile services offered. However, in recent years, the costs of mobile services (including the SIM card, the handset, and the service charges) have come down dramatically, making mobile service affordable for many. This reality is one of the main reasons that Roshan's initiatives have focused on economic development.

By helping customers use mobile services to increase their economic prosperity, Roshan is helping to form new benchmarks around how important and valuable mobile communication is, what mobile is used for, and how much users can afford to spend on it.

• Infrastructure and end-user limitations: With the country still developing its 2G mobile network technology and only one carrier (just recently in March 2012) licensed to use 3G spectrum to sell 3G services, most mobile services must be voice or SMS-based. The high illiteracy rate, estimated to be approximately 70% in 2012, means that interactive voice response (IVR) is the preferred method of service delivery, particularly for information-based services such as Malomat.

• Trailblazing has its drawbacks: Direct competition for Malomat is currently nonexistent, because Roshan carries majority market share in the country and is the only provider offering this type of trading information platform today. Malomat is one of several service innovations that Roshan has been developing since 2003 aimed at elevating the socio-economic position of its customers.

Although these innovations are important differentiators in the mobile service proposition that Roshan offers, being the pioneer of a fundamental part of an emerging market's basic infrastructure has its drawbacks:

The program is still relatively small scale. Expansion will be the key to exploiting Malomat as a service differentiator and to having an impact on the economic status of its customers. Other mobile operators are developing mobile money applications and could launch a similar service, effectively taking Roshan's competitive advantage away.

Strategic Partnerships

• USAID's IDEA-NEW, Global Development Alliance (GDA): A program of the United States Agency for International Development (USAID) created in 2001 as a way to effectively provide aid to underdeveloped countries by combining the energy and resources of corporations, foundations, the faith-based community, indigenous organizations, and other nontraditional partners with the technical expertise and experience of the U.S. government. These public-private alliances leverage an ever-growing private sector, which has the potential to profoundly affect under-developed nations by stimulating economic growth, developing businesses and workforces, addressing health and environmental issues, and expanding access to education and technology. USAID has invested $500 million over five years in Roshan's community and infrastructure development initiatives.

• Mercy Corps: Active in Afghanistan since 1986, Mercy Corps has already helped more than 2.5 million Afghans through a wide range of community-based agriculture and economic development programs. Mercy Corps currently works on a number of agricultural, economic, and women's initiatives across the 12 provinces in northern, southern, and eastern Afghanistan where Mercy Corps is active in the country. Mercy Corps first teamed up with Roshan to launch TradeNet, a joint initiative with Roshan and the precursor to Malomat. TradeNet is the content element of the Malomat service, and publishes the commodities information featured in the service.

• DAI: A global consulting firm that administers the IDEA-NEW program on behalf of USAID, DAI is committed to helping Afghan farmers find alternatives crops to poppy. One of DAI's primary goals is to promote the growing of legal and productive crops in northern and western rural areas of the country that are heavily reliant on poppy production to earn a living. DAI heads up the project team and is joined by Mercy Corps in northeast Afghanistan and ACDI/VOCA in the northwest and central provinces.

Success Metrics

• Roshan launched in 2003 with just 30,000 subscribers. By the close of that year, subscribers had more than quadrupled to 158,000. By 2006, the company had grown subscribers to more than 2 million, and in 2012, the company leads mobile operators in Afghanistan with 32 percent share of the country's mobile subscribers, or almost 6 million subscribers.

• In 2007, Roshan's mobile services were mainly limited to 27 provinces, including coverage in 105 urban centers. In 2011, coinciding with the launch of Malomat and M-Paisa, Roshan extended network coverage to a total 230 cities and towns across all of the country's 34 provinces, covering 60 percent of the population.

• As a result of Roshan's rapid growth, expansion, and service innovations in the more recent past, the company has become the largest private investor and taxpayer in Afghanistan, accounting for about 5 percent of the Afghan government's overall revenue in 2010. Specifically, Roshan's collective service initiatives, including Malomat and M-Paisa, have contributed to job creation in the country. In 2004, Roshan had just 9 employees. In 2011, Roshan directly employed 1,200 people (97 percent of whom are Afghan nationals, and 20 percent of whom are women).

• Malomat can be an important contributor to future subscriber, revenue, and ARPU growth for Roshan. In the program's pilot phase, 500 farmers in 10 provincial wholesale markets used the Malomat service to track 25 crops in 5 of the country's provinces. The program has since expanded to 15 provincial markets, 30 commodities, more than 586 farmers, and 19 traders.

• Although still relatively new, the program has made some notable achievements already. Malomat supported the export of 40 metric tons of fair-trade-certified raisins and another 16 metric tons of fair-trade-certified pomegranates to Europe.

• An indirect benefit of the program is that it gives local growers access to international markets through wholesalers in the program. This access allows farmers to get a much higher price than in their own local markets, where the same crops are in abundance.

Because of the attractiveness and economic advantage of trading goods on the international market, the program also promotes the development of standardized growing practices, which, in turn, help enable fair-trade certification (FLO-CERT). Malomat's partners work in a number of areas of market and infrastructure development such as irrigation, farmer training and education, and other such community and economic support initiatives, many of which are coordinated by Malomat service partners such as Mercy Corp and USAID.

Company Background

Case study source: Cisco sponsored research developed by Ovum.