Experience Innovation

Opportunity

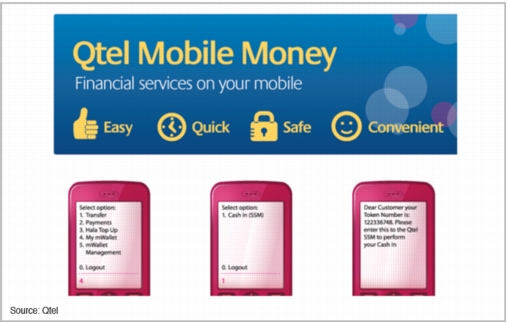

• Create differentiation from the competition and invest in new growth engines of which finance is a key priority. Qtel has increased its focus on mobile value-added services (VAS) in an effort to complement its mobile offerings and drive revenue growth. It has expanded its VAS portfolio, placing a particular emphasis on TV, electronic payments, and health services.

• Provide solution to the demand for new payment and transfer solutions in emerging markets. There is significant potential for mobile money services in Qatar due to:

– Lack of alternative payment solutions

– High proportion of immigrants and international payment transfers

– High mobile penetration (151 percent1 end of Q4 2011)

– Dynamic and growing economy.

Figure 1. Qtel Mobile Money

Challenges

• Qtel has experienced a decline in mobile market share from 77 percent in Q4 2010 to 75 percent in Q4 2011. Vodafone entered the market in mid-2009, and by the end of 2011 had 25 percent market share. Vodafone Qatar has focused on selling bundled devices and data plans.

• Qtel needs to drive additional value from its mobile services by reducing churn, focusing on customer retention, and growing VAS revenue. The company hopes that mobile money services can help it achieve this objective.

• Qtel must help ensure that it develops a balanced portfolio of mobile money services that cater to both its largely lower-income segment of immigrant workers and the higher-end segment to which it is promoting smartphones and higher-speed mobile broadband

• Qtel's plans for mobile money are similar to those of other emerging market operators such as MTN and Bharti Airtel. It faces intense competition from Vodafone in particular. Although the latter's Mobile Money Transfer service is more limited in scope, Vodafone will develop its mobile money services further, and Qtel must build its service quickly.

Strategic Partnership

• Qtel is building up a portfolio of financial partnerships with banks. The primary foundation partner is Qatar's national bank (QNB), but Qtel has also signed deals with others including Mashreq Qatar. Its partnership with Mashreq Online will help Qtel expand the range of services that it offers while helping enable Mashreq's customers to access its mobile payment services.

• Qtel is deploying Sybase's mobile wallet technology, which supports all mobile channels including SMS, Unstructured Supplementary Service Data (USSD), mobile browser, downloadable client, and STK, and works on any mobile device, with any currency.

• Qtel is using EastNets infrastructure for hosting, recovery, and security. Dubai is the main hosting site, and a Disaster Recovery (DR) site is in Bahrain. EastNets is also delivering compliance and anti-money laundering (AML) solutions to the Qtel Group through the en.SafeWatch Profiling as a Service (PaaS).

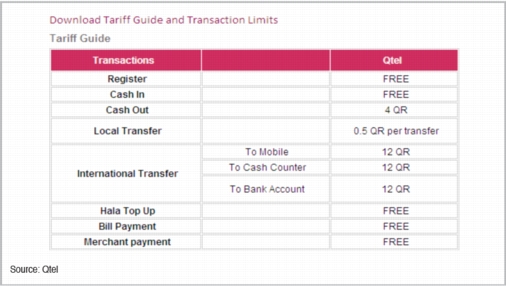

Figure 2. Qtel Mobile Money: Mix of Paid For and Free Services

Success Metrics/Monetization

• Direct revenues from paid for services, such as charges for all money transfer services (see Figure 2). Other services are offered for free, such as top-ups and bill/merchant payments.

• Indirect value. A key objective for mobile money is to increase stickiness. Qtel has an advantage here, because it is the first player to launch a comprehensive mobile money portfolio in Qatar.

• Qtel intends to deploy the service to its other operating markets over time, increasing the long-term revenue potential from mobile money.

• Mobile money services were only launched at the end of 2011, so little data is available in terms of uptake and usage. However, in the context of Qtel's drive to grow ARPU, the signs are encouraging (ARPU grew from US$37.0 in Q4 2010 to $39.9 by Q4 2011). In Qatar, Qtel's revenues grew by 4.3 percent year-on-year in 4Q11, while its EBITDA margin grew by 0.4 percentage points year-on-year to 48.4 percent due to lower opex growth.

Company Background

• Qtel web site: www.Qtel.qa

Case study source: Cisco sponsored research developed by Ovum.