Challenge/Opportunity

• According to Ovum, in mature and highly competitive broadband markets, a strong Content Everywhere offering in itself is not enough and must be combined with both competitive pricing to win market share of mainstream customers and strategic marketing aimed at winning reluctant broadband and digital media adopters.

• Orange faces a considerable challenge in developing a full-blown triple-play strategy, which includes mainstream TV and VoD in markets where it is a challenger, not an incumbent. To date, much of Orange's growth in both TV subscribers and revenue has derived from its home markets of France and Poland.

• Plans for an IPTV launch in the United Kingdom were shelved due to unfavorable market conditions (although a merged T-mobile/Orange will be in a much stronger position), forcing Orange to focus on mobile/PC-related content only. Even in markets where it has launched a full triple-play offer, it has had mixed results due to the economic recession affecting those markets as well as the strong competition that it has had to face.

• In markets where Orange's TV presence is weak, realistically, Orange is only likely to achieve significant growth in the short- to medium-term either via acquisition or by the development of hard-hitting partnerships.

• Orange has a powerful brand and a substantial mobile and broadband subscriber base, giving it a good opportunity to capture new revenues in content and related services.

• Orange's Content Everywhere strategy seeks to leverage scale, brand, and market position to develop more personalized and relevant content across platforms not only to generate additional revenue, but also to differentiate itself from competitors and win market share in fixed and mobile broadband.

• Multiscreen delivery of content is of particular importance to Orange. IPTV and web video have seen encouraging uptake in France and Poland, but the recent boom in smartphones and mobile broadband underlines the popularity of mobile TV. Orange has seen strong growth, particularly in areas where it can leverage its premium content portfolio (e.g., live sports and reality TV shows).

• Orange is also pursuing opportunities in cross-platform advertising solutions. It launched multiscreen advertising in France and Spain in mid-2008. Over the course of 2009, it implemented a pan-Europe segmentation, which is also aimed at providing a more effective means of targeting advertising.

• Orange is also leveraging its content assets outside its subscriber footprint. Its "Video Party" service aggregates its pay content and free content in one portal, which non-Orange customers can purchase using a credit card or "Video Tickets."

Alliances/Partnerships

• For delivery of its main IPTV service, Orange partnered with an IPTV set-top box (STB) manufacturer and a home gateway/middleware vendor. Orange launched its "Soft At Home" initiative with these partners to facilitate a more open distribution model and a coordinated eco-system within the home (with the service provider taking a central role). The SoftAtHome platform runs on home gateways, STBs, and network-attached servers. PCs, mobile phones, PDAs, and other consumer devices can be connected to this platform.

• In January 2010, Orange signed a three-year partnership with LG Electronics to offer access to an Orange portal offering multimedia services (Orange Sport info, news, live radio, TV programs, music) on Internet-connected LG televisions. From March 2010, the portal is accessible with a button on the TV remote control.

• In March 2010, Orange announced a partnership with NetVibes to provide mobile customers with access to a large portfolio of widgets (Orange widgets were launched in July 2009). The aim is to provide access to popular local content in customers' own language, with Orange envisaging extending widgets to Orange portals on TVs and fixed broadband-connected devices.

Strategy

• In December 2009, Orange launched an Orange App Shop, an on-device client distributed over the air. This feature provides one-click access from the Orange homescreen to Orange TV, games, and maps alongside a growing catalogue of mobile applications from key content providers and third-party application developers.

• Orange offers more flexibility in how customers can purchase premium content. It has an innovative customer segmentation more suited to its custom base, which enables the company to cater to its customers' demands more closely.

• Orange has produced solid financial results over the past few years, which has helped to boost the financing and the extensive resources required to deliver a full-blown multiscreen content and advertising strategy. This financial position gives Orange an edge over national rivals in two key areas: content ownership and content expertise via R&D investments. Content ownership underpins Orange's success in driving IPTV/VoD uptake and sales. It gives Orange superior leverage over telco rivals and a greater competitive edge in competing with the Canal+ group. Content ownership also provides Orange with much more maneuverability for innovation in content availability, formats, and portability.

• Orange has developed its own programs and formats for premium content where it sees a significant opportunity for further revenue growth. For example, it has its own Orange Sports channel with Orange presenters and experts, and is developing and testing technologies for new formats (e.g., training crews to capture images in 3D).

• Orange is also acting as what it terms a network editor: i.e., offering smart enabler services to third-party content partners, and allowing these partners to further enhance their offerings.

Success Factors/Metrics/Monetization

Company Background

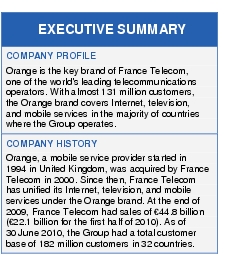

• Read Orange overview