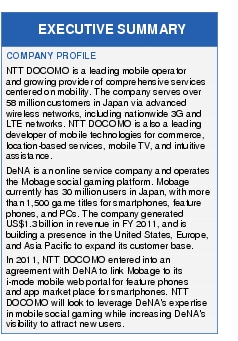

Experience Innovation

Potential Barriers

• Competitive marketplace. In Japan, Mobage faces competition from GREE, Japan's premier social gaming provider. However, with a healthy growth in both revenue and average revenue per use (ARPU), an expanding catalogue of gaming titles, and the NTT DOCOMO partnership, Mobage is in a stronger position to grow in the crowded Japanese market.

• Localizing services. Expanding beyond Japan requires working closely with local game developers and content providers to customize for language and cultural preferences. For example, social gaming in Europe is played with friends who are already members of the social network. In Japan, the social network grows out of the gamer interaction. A strong emphasis also exists in Japanese gaming on virtual goods and avatars, and titles are often popular across different media.

Figure 1. Mobage Social Mobile Gaming

Opportunity

• Differentiating from competitors. For NTT DOCOMO, the DeNA partnership draws in new subscribers, enhances its service offering, and increases customer engagement. Additionally, the move reinforces the operator's role in content provisioning in a market increasingly dominated by app stores. It also provides the feature-phone-owning population with an ability to take part in the gaming trend and enhanced online purchasing.

• Gaining first-mover advantage by exporting social gaming. Digital gaming revenue is forecast to exceed $30 billion in 2016 in Asia-Pacific alone, and 27 percent of these revenues will be generated from the mobile channel. The partnership will enable NTT DOCOMO to tap into the growing digital games opportunity in Japan, and be one of the first providers to introduce Japanese style social gaming to Europe.

• Reducing churn and sustaining revenue growth. NTT DOCOMO's i-mode service has been providing subscribers with services such as billing and games since 1999. But the disruptive app store ecosystem has given consumers the ability to bypass i-mode altogether. The DeNA partnership will enable NTT DOCOMO to increase service offerings and engage users beyond the virtual goods purchased via Mobage to a wider variety of mobile commerce services.

Strategic Partnership

• Offering exclusive DeNA games to users within Japan and Asia

• Exporting the social gaming model to Europe

Success Metrics/Monetization

• Mobage user growth in Japan has almost doubled from 2009 to mid-2010, from 15.10 million in September 2009 to 29.1 million in June 2010.

• NTT DOCOMO has a 59 million customer base in Japan, not counting its global subsidiaries.

• DeNA has a revenue run rate of over a $1 billion, with 86 percent of its revenue coming from its social platform.

• ARPU from Mobage on smartphones nearly doubled in the three months after carrier billing was introduced.

• Revenue share for content and games downloaded

• Revenue gains from being the primary billing agent for the service

• Increase in ARPU and overall revenue by offering social games to smartphone and feature phone users

• Benefits from greater subscriber engagement and loyalty, keeping churn low and customer satisfaction high

Company Background

Case study source: Cisco sponsored research developed by Ovum.