Challenge/Opportunity

• Only 1 percent of all Internet content worldwide is in Arabic, despite a high demand for Arabic content. This demand is set to grow with the increase in mobile and PC data usage.

• A demand also exists for a safe and trusted online space that is compatible with the cultural context of the Middle East.

• The Middle East and North Africa (MENA) region lacks a pan-Arab digital player that consistently provides a single destination for digital content that supports both fixed and mobile communication devices.

• Anayou is du's social network offering, which is part of its digital content strategy. The overcrowded social networking space is difficult to penetrate with the heavy presence of Facebook, MySpace, and Yahoo-acquired Maktoob.

• Pure Arabic social networks have been launched in the past and have not been successful. It is hoped that the unique content offering and Internet television would serve as Anayou's competitive advantage and provide du with a better chance of success than others.

• Although du has a strong subscriber base in the UAE that it can leverage, Anayou (and Nxt) is soon to be launched across the Middle East. The primary challenge will be to gain subscribers in the rest of the MENA region, where du does not have a strong presence.

Alliances/Partnerships

• Alliances with established gaming firms such as Eurosport Arabia and F4 Gaming bring several multiplayer online games to the portal.

• Du has partnered with GETMO Arabia to provide online music.

• A partnership with Rotana will deliver music and film content, while yet another partnership with MBC will result in television content for the platform.

• Anayou and Prodea Systems have teamed up to offer Nxt, an Internet service delivery platform. Nxt social will offer personalized social applications on the television while the user watches TV, such as streaming YouTube videos and Facebook applications.

• Other alliances include Funambol and Hungama to provide additional content.

Experience Innovation

Success Factors/Metrics/Monetization

• The digital strategy will leverage du's large subscriber base and the high level of demand for relevant Arabic content to create a new, sustained revenue stream in the form of streaming video content, gaming, virtual worlds, and social networking. This trend will further strengthen du's market position by adding to their subscriber base as well as establishing a strong presence beyond the UAE and to the rest of the Middle East.

• The current market for value-added services in the Middle East is estimated at around US$350 million. Future growth is expected to come from value-added services categories such as general entertainment, interactive media services, gaming, and information. The total market is estimated at over US$1.7 billion by 2010.

• Each of the components of the digital strategy will have a separate business model; however, the main premise for revenue generation will be through online advertising and other revenue-sharing agreements.

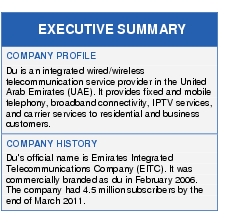

Company Background

• Read Du Telecom overview

Case Study Source: Cisco sponsored research developed by Ovum