Challenge/Opportunity

• The incomes of Indian rural residents are significantly lower than urban residents. The average revenue per user (ARPU) for rural residents was typically less than US$2 per month.

• Besides deploying a scalable network, Bharti Airtel also needed to establish a cost-effective marketing, sales, and distribution channel to provide service promotion and customer support.

• The future growth of the Indian mobile market is expected to be driven by rural customers, which account for about 70 percent of the country's total population (1.1 billion people) with a teledensity of only 18.5 percent as of September 2009. Indian urban mobile penetration is already over 100 percent.

• Rural dwellers place a high value on communications. Contacting urban/overseas relatives and friends often requires a long and sometimes treacherous trip to the nearest town to reach a payphone.

• Various studies (e.g., fishermen in the Indian state of Kerala and grain producers in Niger) have shown that increased mobile service penetration in rural areas could have tremendous socio-economic benefits for the rural population.

• With its strong presence in the relatively untapped rural market (over 27 percent market share as of September 2009), Bharti Airtel is well-placed to continue growth with its focus on under-penetrated Indian regions with new revenue streams such 3G-enabled data services and pay-TV.

Alliances/Partnerships

• Bharti Airtel has launched microfinancing agreements in collaboration with Nokia and SKS Micro-finance. Under these partnerships, Bharti provides subsidized tariffs and subscriber identity module (SIM) cards to rural users, Nokia provides subsidized handsets, and SKS offers microfinancing.

• To expand coverage into rural regions, Bharti Airtel is sharing passive infrastructure services with Vodafone (42 percent ownership) and Idea (16 percent ownership) through its joint venture, Indus Towers. Sharing the infrastructure cost and usage between multiple operators has helped Bharti Airtel to reduce its operating and capital expenses.

• Bharti Airtel also formed a joint venture with the Indian Farmers Fertilizer Cooperative Limited (IFFCO). Its joint venture, IFFCO Kisan Sanchar, uses IFFCO's wide rural presence (present in 80 percent of Indian villages) and appeal among the rural agricultural community to market and distribute Bharti's products.

• IFFCO Kisan Sanchar provides subsidized handsets and connections at competitive rates in rural areas. It also helps Bharti Airtel to identify and acquire suitable locations for deploying its cell sites. In addition, it offers tailored services including voice-based updates on crop prices, farming techniques, rural health initiatives, and "help line" services.

Strategy

• Bharti Airtel has adopted the strategy of direct communications to market its value proposition to rural customers. To make its services accessible, the company provides all of its marketing content in local languages. Vans are used to cover rural areas with staff who educate locals about mobile services and usage.

• The company has developed a shared phone service called Public Call Offices (PCOs) in rural regions to increase awareness about its brand and services.

• Bharti Airtel Service Centers have been set up in villages to address customer queries and complaints as well as act as sales and distribution points. These centers employ local people and offer sales and customer services using local dialects.

• Bharti Airtel has already established over 18,000 service centers in rural India, covering over 400 languages and local dialects. The company plans to expand this network.

Success Factors/Metrics/Monetization

• As of April 2010, Bharti Airtel's network covered 440,000 villages in India, which, together with its urban services, accounted for coverage of approximately 84 percent of India's total population.

• As of March 31, 2010, Bharti Airtel had added 9 million new customers to reach a total of 128 million connections. Ovum estimates that rural users accounted for 60 percent of the company's net subscriber adds in that quarter.

• Despite Bharti Airetel's overall ARPU of just under $5, its mobile division's earnings before interest, taxes, depreciation, and amortization (EBITDA) margin was approximately 30 percent, and its earnings before interest and taxes (EBIT) margin was approximately 19 percent, which indicate a healthy return on overall (including significant rural) investments.

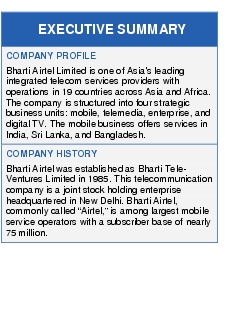

Company Background

• Read Bharti Airtel overview