The New World of Wi-Fi and Small Cells

Top 10 Research Findings

Mobile usage has definitely shifted to the home in a big way. Almost all consumers use their mobile devices at home, averaging more than 3.8 hours of use in a typical day, almost double the time they spend using them at work or school. Just under half of our respondents reported using their devices at work or school, where they typically spend an average of 2.8 hours per day connected to Wi-Fi. These daily-use figures have grown significantly since our 2012 survey, with 52 percent and 65 percent increases in the number of hours spent using Wi-Fi-connected mobile devices in the home and at work or school, respectively.

Homes and the workplace are now virtually blanketed with Wi-Fi. Nine out of ten American homes now have access to Wi-Fi. Sixty percent of full-time employees report having Wi-Fi in their workplace, and for knowledge-worker professions, the Wi-Fi workplace coverage expands to 70 percent of full-time employees.

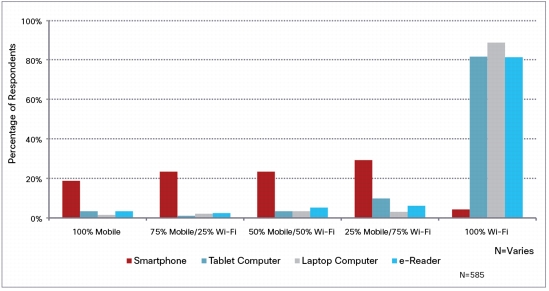

Consumers increasingly rely on and prefer Wi-Fi for connecting their mobile devices to the Internet. As Figure 1 shows, most mobile users connect their devices using Wi-Fi at some point during a typical week, including 80 percent of smartphone owners. This is a significant increase in smartphone Wi-Fi connections, from 70 percent in our 2012 survey. Close to 80 percent of tablets, laptops, and eReaders are now connecting exclusively through Wi-Fi.

Although 20 percent of smartphone owners connect only through the mobile network, the remaining 80 percent are supplementing mobile connectivity with Wi-Fi. In fact, when connecting a device to the Internet, the average smartphone user uses Wi-Fi 44 percent of the time. This is a remarkable increase from just one year ago, when one-third of the total smartphone data usage was through a Wi-Fi connection, rather than a mobile network.

Figure 1. Current Distribution of Network Connectivity by Time

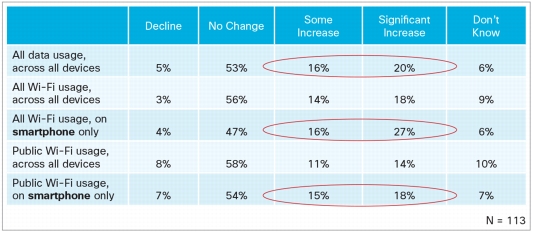

The mobile industry is currently divided about the relationship between LTE and Wi-Fi. Some see Wi-Fi as a transition technology on the way to LTE, and once users have LTE, they will no longer need Wi-Fi to achieve higher mobile data speeds. Other industry pundits question why we need LTE, if Wi-Fi can provide high data throughputs and much of the mobility of LTE. Our research shows that the relationship between LTE and Wi-Fi is much more complex than this binary view. The two technologies actually appear to be complementary and synergistic. As Figure 2 shows, a significant number of LTE smartphone users have actually increased both their total data usage and Wi-Fi usage, after they make the transition to LTE. Thirty-six percent of LTE smartphone users reported that their total data usage across all devices increased, to some extent or significantly, after they moved to LTE. Forty-three percent of people reported that they also used more Wi-Fi on their smartphones after upgrading to LTE. And one-third of LTE smartphone users increased their use of public Wi-Fi on their smartphones, even though they were LTE-enabled.

Figure 2. Change in Data Usage with LTE (4G/LTE Smartphone Users)

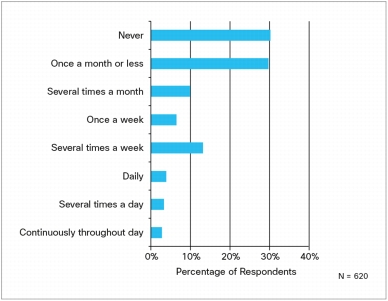

A remarkable 70 percent of mobile users are now using public hotspots (Figure 3). Of those public hotspot users, 57 percent of them use it at least weekly. This is a significant increase from our 2012 mobile consumer survey, which found one-third of mobile users taking advantage of a public hotspot at least weekly and only 13 percent connecting more than once per week. Today those numbers have more than doubled. Close to six out of ten public Wi-Fi users now connect to a hotspot at least weekly, and one-third connect more than once a week.

While many of these connected consumers may just connect to a hotspot for a brief time to collect their latest email or check some information on the web, almost one-half of users are spending longer than 30 minutes connected to a public hotspot. In fact, mobile users spend an average of 44 minutes connected to the Internet every time they use a public Wi-Fi hotspot. And 17 percent of users measure their individual public Wi-Fi sessions in hours rather than minutes.

Figure 3. Public Wi-Fi Usage Frequency

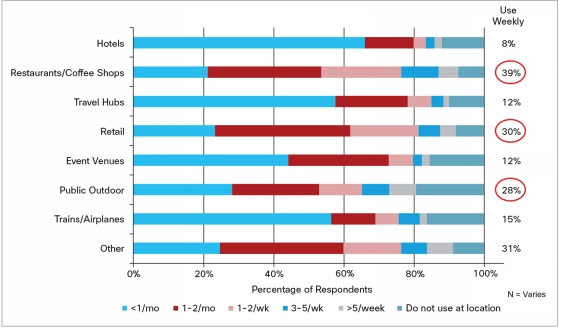

Smartphones are the predominant mobile device used in public Wi-Fi hotspots. As Figure 4 shows, approximately 80 percent of all smartphone owners connect to public Wi-Fi at some point during the week. Almost one-third of smartphone owners are connecting to hotspots in retail stores, outdoors, or other public locations, such as libraries or doctor offices, at least weekly. Tablets owners most often use public Wi-Fi in hotels, travel hubs, coffee shops, and trains and airplanes. However, aside from coffee shops, the greatest weekly use of public Wi-Fi for tablets occurs in retail, outdoors, and other public locations. Public Wi-Fi use by laptops shows a business-user profile similar to that of tablets, with use occurring most frequently in hotels, travel hubs, coffee shops, and trains and airplanes. Laptops are used much less frequently on a weekly basis, only 10 to 15 percent of owners regularly use them in most public Wi-Fi locations.

Figure 4. Frequency of Public Wi-Fi Use by Locations for Smartphones

The seventy percent of consumers using public hotspots are generally quite satisfied with the service. They give high ratings to the ease of use, quality, and overall experience of public Wi-Fi. Areas for improvement include speed, security, privacy, and, of course, coverage.

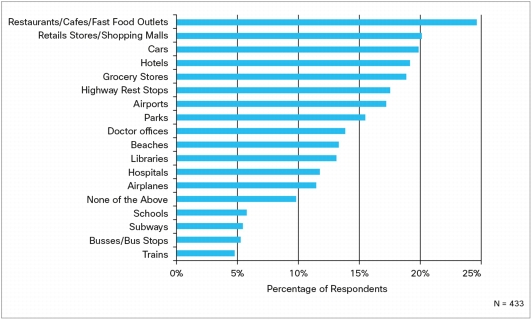

Availability of public hotspots ranks as the number one challenge that mobile users have with public Wi-Fi. They just want more of them in more places. As Figure 5 shows, not only do consumers want more hotspots in the traditional public Wi-Fi locations, like coffee shops, hotels, and travel hubs, but they also expect hotspots to be available wherever they spend their lives outside the home, work, or school. Consumers would now like to see Wi-Fi available in the next tier of locations, such as shopping malls, stores, highway rest stops, doctor's offices, and parks.

Figure 5. Preferences for New Public Hot Spot Locations

The general user satisfaction with public Wi-Fi extends to most locations where consumers are connecting. In particular, mobile users are very satisfied with the Wi-Fi connections and experience in hotels, restaurants, and coffee shops. However, consumers see room for improvement in the Wi-Fi offered in public outdoor and retail locations.

To date, most service providers have viewed Wi-Fi as a means to offload some mobile data traffic and help retain customers. However, we have discovered new ways to make money by unlocking the inherent business value hidden in the Wi-Fi infrastructure to create localized and personalized mobile experiences. Specifically, we found a significant level of customer interest in the following three new, innovative business models:

• Enhanced retail experience: This integrated mobile solution helps improve the in-store shopping experience, with such offerings as product information, an in-store location finder, integrated shopping lists, coupons for special offers, and automated checkout. The features perceived as most beneficial are: scanning and purchasing items on mobile device, personalized offers, real-time directions in the store, and relevant product information.

• Enhanced airport experience: This integrated mobile solution can improve the airport experience. It includes such things as airport information, mobile check-in, maps and directions, coupons for special offers at shops and food outlets, and flight and gate alerts. The features perceived as most beneficial are real-time flight updates and alerts, flight check-in using the device, advice on best check-in and security queues based on wait times, and real-time directions in the airport.

• Enhanced public venue experience (e.g., stadium or shopping mall): This integrated mobile solution can improve the experience in a large public venue. It includes such things as venue information, maps and directions, coupons for special offers at shops and food outlets, and information on upcoming events. The features perceived as most beneficial are personalized offers for food and shops; real-time directions to stores, vendors, and elsewhere; notification of events of personalized interest; and venue maps.

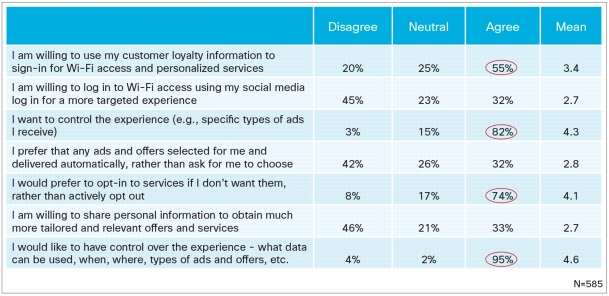

While consumers recognize that they will have to relinquish some of their personal information to get a better mobile-user experience, they are still concerned about who will have access to their data and how it will be used. As shown in Figure 6, mobile users are willing to use their customer loyalty information to sign in for Wi-Fi access and personalized services, but they feel strongly want about having control over the experience. They want to control what data can be used, as well as when and where it can be used. They also want to control the types and quantity of advertisements they receive. Consumers would also prefer having the ability to opt in to these new services, rather than having to actively opt out of the service. Mobile consumers also want control over how ads and personal offers are delivered to them. They would much rather choose which ads and offers are delivered than have ads and offers appear automatically on their mobile devices.

Figure 6. User Perspectives on Personal Privacy

Licensed small cells offer mobile operators a means to fill in coverage holes in their macro networks and provide much better mobile coverage in indoor environments. We found that good mobile coverage is still a major concern for consumers and plays a significant role in dissatisfaction. Forty-five percent of full-time employed mobile users stated that they would be likely to switch carriers for better coverage. The impact of coverage quality on churn is particularly important when you consider the following findings: Our research revealed that one-half of knowledge workers use their mobile phone in the office, instead of their desk phone, at least one-quarter of the time. In addition, one-third of workers make equal use their mobile and desk phones in the office. Consumers also identified concerns about their mobile coverage in retail locations, event venues, such as stadiums and conference facilities, and trains.

Top Five Mobile and Wi-Fi Predictions

• Close to 100 percent of smartphones will use Wi-Fi.

• Smartphone owners will use Wi-Fi at least 50 percent of the time to connect to the Internet.

• Eighty percent of all mobile consumers will use public Wi-Fi.

• Seventy-five percent of all public Wi-Fi users will use this technology at least weekly in some location.

• Sixty percent of public Wi-Fi users will access social media.

• Forty percent of public Wi-Fi users will stream music or video.

Winning in the New World of Service Provider Wi-Fi and Small Cells

• Incorporate Wi-Fi as an integral part of your portfolio. Use pricing, marketing, and new technological solutions to create compelling and integrated offers and solutions of value to mobile users.

• Target Wi-Fi use in the home. Create solutions and incentives to encourage users to offload mobile traffic at home, while you retain the ability to provide a unique and differentiated mobile experience.

• Expand Wi-Fi footprint. Expand footprint in existing locations and new locations through deployment, new business models, and partnerships.

• Actively pursue new Wi-Fi monetization opportunities. Develop new offers that enhance the customer experience, differentiate the service provider-managed service offering, and deliver new sources of revenue.

• Develop proactive personal data strategies and communications. Undertake extensive customer research to formulate comprehensive data policies and strategies and actively communicate them to customers.

• Deploy small cells to improve mobile quality. Deploy small cells and Wi-Fi in key congestion and coverage areas as part of a comprehensive strategy.

About the Survey

Acknowledgements

References

• "Understanding the Changing Mobile User"

• "What Do Consumers Want from Public Wi-Fi?"

• "Unlocking Wi-Fi Enabled Value-Added Services"

For More Information

Stuart Taylor, Director

Service Provider Transformation Group

+1 978 936 0022

stuart.r.taylor@cisco.com