Principles of financing

You will find outlined below an overview of 5 fundamental terms or concepts of financing, that we, in Cisco Capital, refer to as the 'Principles'.

These Principles can* be combined to offer innovative, flexible and competitive financing solutions for our customers. For more information, contact your Leasing Account Manager (who you should consider as your Financial SE)

- Principle 1: Cash Flow Play (Finance Lease)

- Principle 2: Flexible Repayments

- Principle 3: Residual Value Operating Lease

- Principle 4: Sale & Leaseback

- Principle 5: Technology Refresh

Principle 1: Cash Flow Play (Finance Lease)A simple finance agreement which lets the customer acquire a Cisco solution right away and spread the cost over time, up to five years. Unlike a cash purchase, this basic finance agreement enables the customer to have smaller, predictable and more manageable payments. This creates budget today and enables you to sell additional products and/or services. Finance leases normally appear on a customer's balance sheet and will normally be charged against the customer's capital budget. |

Principle 2: Flexible RepaymentsThe customer can structure their repayments in line with their business needs or to accommodate the business benefits that will be derived from the technology solution. For example, in rolling out complex solutions, this option can allow a customer to fully deploy the solution before they start paying for it. Repayment structures can also be aligned in accordance with seasonal revenue peaks, for example within the tourism, retail or education industries test |

Principle 3: Residual Value Operating LeaseOperating leases offer the lowest monthly payments. Unlike the cash flow principle (or finance lease), this option requires Cisco Capital to take a Residual Value (RV) position on the equipment. This means that the value financed is in effect reduced and your customer will therefore benefit from lower payments. In addition, equipment financed under an operating lease will not normally appear on your customer's balance sheet. As a result, payments under an operating lease are generally treated as operating expenses (which are allowable against taxable income) and will not impact your customer's capital budget. At the end of the agreement, the customer has the flexibility to migrate to new equipment in order to satisfy any changing business requirements by returning the equipment to Cisco Capital (which means it will be disposed of according to local regulations and guidelines). Alternatively, if the customer wishes to retain the equipment, an extension rental can be calculated. In some instances, it may also be possible for the customer to obtain title (ownership) of the equipment for Fair Market Value. |

Principle 4: Sale & LeasebackThis helps customers who want to migrate to a new Cisco solution but are challenged because they have technology assets which are not yet fully depreciated. Cisco Capital pays for the outstanding costs (Net Book Value) of the existing equipment and then incorporates these costs into a new finance arrangement, spreading the payment costs over time. This provides the customers with a cash injection for their old assets and therefore avoids any short term balance sheet write-offs. In a similar manner, it may also be possible to accommodate the settlement of outstanding financial liabilities for leased technology assets. |

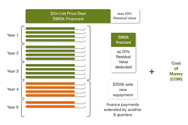

Principle 5: Technology RefreshThe technology refresh option allows your customers to adapt their technology in line with their business needs (or as new technologies are introduced) without major cash expenditure. This is achieved during the finance term by Cisco Capital providing the customer with the ability to refresh a proportion of the original solution for new equipment. |

* subject to terms and conditions, credit rating, etc